KISS YOUR CASH GOODBYE!

FDIC Meeting discloses the public trusts the FDIC more than the FDIC trusts itself.

FDIC Systemic Resolution Advisory Committee – November 9, 2022 Webcast

Hide bank failures from the public.

Today’s Take: Gold & Silver Are The Ultimate Safe Havens Feat Andy Schectman from Miles Franklin

Key points:

1. Created new regulatory agencies (Consumer Financial Protection Bureau)

2. Increased bank capital requirements

3. Implemented the Volcker Rule limiting banks’ speculative trading

4. Established procedures for “orderly liquidation” of failing financial institutions

5. Added regulations for derivatives markets

6. Introduced “living wills” requirement for major banks

7. Enhanced consumer protections in financial services

Notably, Title II of the act permits bail-ins, allowing banks to convert depositor funds into bank equity during a crisis, putting customer deposits at risk above FDIC insurance limits.

The act aimed to prevent another financial crisis but has been criticized for increasing regulatory burden and potentially enabling bank confiscation of deposits.

From Bailouts to Bail-Ins: Understanding the Dodd-Frank Act

BAIL-IN DEFINITION

A bail-in is when a failing bank converts its liabilities (including customer deposits) into equity to recapitalize itself. Crucially, when you deposit money in a bank, you’re technically making an unsecured loan to the bank – you become an unsecured creditor. In a bail-in, these deposits above government insurance limits can be converted to bank shares or written down to absorb losses, unlike a bailout where external funds rescue the bank. This happened in Cyprus in 2013, where uninsured deposits over €100,000 were partially converted to bank equity.

Central Bank Digital Currency (CBDC) FAQ

CBDC (Central Bank Digital Currency)

A Central Bank Digital Currency (CBDC) is a programmable digital form of money issued directly by government, enabling complete surveillance and control over individual spending. Unlike cash or traditional banking, CBDCs can be programmed to restrict purchases, expire funds, enforce social compliance, and track every transaction. This represents a fundamental shift from financial privacy and freedom to a system where government can monitor, approve, or deny any economic activity at the individual level.

How bank failures will channel customer deposits to the CBDC financial system.

Bank failures can significantly influence the flow of customer deposits to Central Bank Digital Currency (CBDC) systems in several ways:

1. **Loss of Confidence**: When banks fail, customers often lose trust in traditional banking systems. This may lead them to seek safer alternatives, such as CBDCs, which are backed by central banks.

2. **Immediate Access and Security**: CBDCs can provide a secure and accessible alternative for individuals worried about the stability of their deposits in failing banks. The digital nature of CBDCs allows for faster transactions and easy access, appealing to customers looking for safety.

3. **Government Intervention**: In times of bank failures, governments may promote the use of CBDCs as a more stable means of holding value. They might incentivize deposits in CBDCs through guarantees or limited-time offers, further encouraging the shift.

4. **Regulatory Changes**: Regulatory responses to bank failures could lead to a more favorable environment for CBDCs, potentially easing adoption and encouraging customers to transition their deposits.

5. **Technological Adoption**: As customers become more familiar with digital currencies and financial technologies, the convenience and innovation of CBDCs can attract deposits that might otherwise remain in traditional banks.

6. **Systemic Risks**: In a crisis, the systemic risks associated with commercial banks can lead customers to diversify their holdings. CBDCs represent a government-backed option that may be perceived as less risky.

Overall, bank failures could act as a catalyst for greater adoption of CBDCs, as customers seek more secure and reliable means of holding their funds.

A comparison demonstrating financial freedom in the current US Banking system in contrast to that of the upcoming CBDC system which will attach buying habits, social credit scores and an individuals carbon footprint to their ability to use money.

Current US Banking:

- Choice between multiple banks

- Option to use cash anonymously

- Ability to withdraw/hold physical money

- Freedom to spend on legal items without scrutiny

- Private transaction history

- Can opt out of banking system

CBDC System:

- Single government-controlled currency

- All transactions digitally tracked

- No anonymous transactions

- Spending restricted based on:

- Social credit score

- Carbon footprint

- Government-approved purchases

- Funds can be frozen/expired

- Programmable money with usage restrictions

- Mandatory participation

- Direct government surveillance of all financial activity

The key difference is personal autonomy vs. centralized control.

$22 Trillion in US Banking System Backed by Just $225 Billion at FDIC

According to the FDIC, $124.5 billion is currently on the agency’s balance sheet, with an additional $100 billion line of credit available from the U.S. Treasury, for a total of $224.5 billion.

That compares to a staggering total of more than $22 trillion in the US banking system, says Gurbacs.

DEBT IS NOT AN ASSET! DEBT IS NOT AN ASSET!

DEBT IS NOT AN ASSET! DEBT IS NOT AN ASSET!

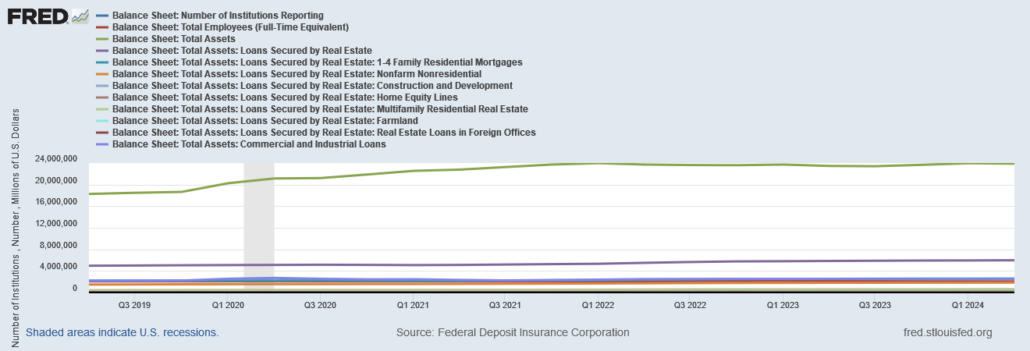

Federal Reserve of St Louis Graph

Today’s Balance Sheet shows

$24 Trillion

The FDIC Spent 20B to “Bail-Out” Silicon Valley Bank which was ILLEGAL!

U.S. Banks Sitting on $750 billion In Losses On Real Estate Debt Related Securities-Which Sectors Are Most Exposed?

The 2008 financial crisis exposed numerous flaws in America’s financial system, such as the inherent danger of America’s largest banks being overleveraged. Significant dangers remain despite a slate of reforms designed to keep banks on sound financial footing going forward. A recent article in Cryptopolitan magazine revealed that American banks’ potential loss exposure on real estate-related securities skyrocketed to $750 billion in Q3 2024.